Cheapest Way to Use Square

Square is a popular payment solution for businesses. Finding the cheapest way to use it can save you money.

Square offers various tools for small businesses. They provide easy ways to accept payments, manage sales, and track inventory. But costs can add up. This blog will help you find the most cost-effective ways to use Square. Saving money on transactions and fees is crucial for businesses.

We’ll explore tips and tricks to reduce costs without sacrificing quality. Whether you’re a new business or looking to cut costs, this guide will help. Stay tuned to learn how to make the most of Square without breaking the bank.

Credit: 10web.io

Introduction To Square

Welcome to the world of Square! If you run a small business, you need a reliable and affordable payment solution. Square might be what you need. This blog will guide you through using Square in a cost-effective way.

What Is Square?

Square is a financial services and mobile payment company. Founded in 2009, it offers a range of tools for small businesses. Square allows you to accept credit card payments through a simple reader. You can use their software on a phone or tablet.

Square’s Key Features

Square has many features to help manage your business. Here are the main ones:

- Point of Sale (POS) System: This system helps you track sales and inventory.

- Payment Processing: Accept payments from all major credit cards.

- Invoicing: Send professional invoices directly to your customers.

- Online Store: Create an online store with built-in payment processing.

- Analytics: Detailed reports to help you understand your business better.

- Employee Management: Manage your team and track work hours easily.

Square offers many tools to simplify running a business. These features can save you time and money. Whether you sell in person or online, Square has something for you.

Setting Up Square Account

Setting up a Square account is the first step to start accepting payments. It’s straightforward and quick. Follow these steps to create and verify your account efficiently.

Creating An Account

To create an account, visit the Square website. Click on the “Sign Up” button. You will need to provide some basic details:

- Full Name

- Email Address

- Password

- Business Information

Ensure your password is strong. Use a mix of letters, numbers, and symbols. Once all details are filled, click “Create Account”.

Account Verification

After creating your account, Square will need to verify your identity. This step ensures the safety and security of your transactions.

To verify your account, you will need:

- Social Security Number (SSN) or Employer Identification Number (EIN)

- Business Address

- Bank Account Information

Square may also ask for additional documents. These could include:

- Government-issued ID

- Business License

Once you provide the necessary information, Square will review and approve your account. This process usually takes a few minutes but can take up to 24 hours.

After verification, you can start using Square to accept payments. Make sure your bank account is linked correctly. This ensures you receive funds without any delays.

Choosing A Square Plan

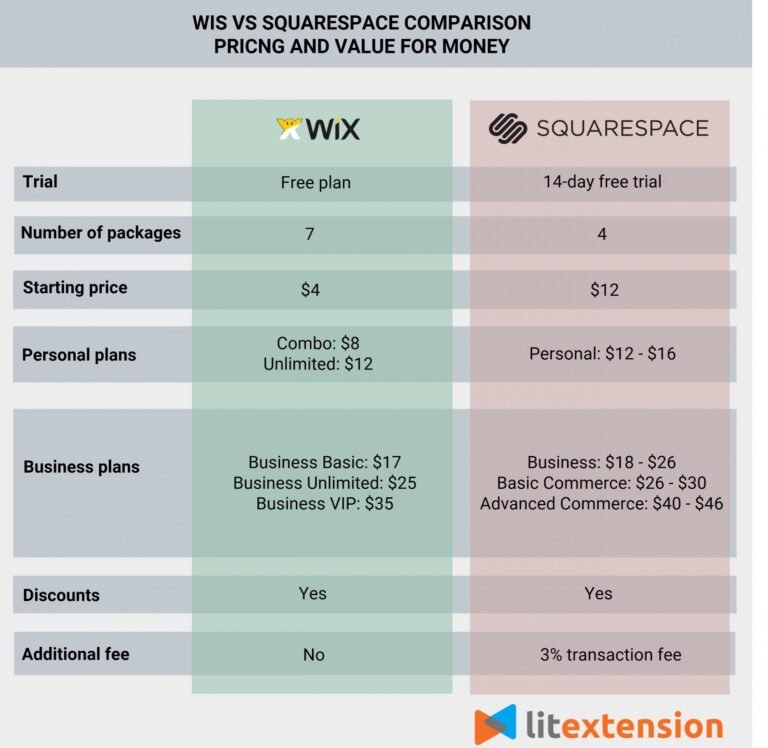

Choosing the right Square plan can save you money while meeting your needs. Whether you’re new to Square or a seasoned user, understanding the options helps. Let’s explore the benefits of both free and paid plans.

Free Plan Benefits

The Free Plan offers essential features for small businesses. You get a free point-of-sale (POS) system. This includes inventory management and sales reporting. With no monthly fees, it’s budget-friendly. You only pay transaction fees. These fees are a small percentage of each sale. This plan is ideal for startups or businesses with low sales volume. It’s a great way to test Square without financial risk.

Paid Plans Overview

Square’s paid plans offer more advanced features. They cater to growing businesses. The Plus Plan includes more tools for customer engagement. You get advanced reporting and marketing features. It also offers a loyalty program. The Premium Plan is for larger businesses. It provides custom pricing and dedicated support. Both paid plans have monthly fees. They also include lower transaction fees than the Free Plan.

Choosing a paid plan can enhance your business operations. You get access to premium tools and support. This can lead to better customer satisfaction and higher sales. Evaluate your business needs and budget before making a decision.

Hardware Options For Square

Square provides various hardware options to meet your business needs. These range from free card readers to affordable hardware solutions. This flexibility ensures you can accept payments without breaking the bank.

Free Card Reader

Square offers a free card reader to all new users. This basic model plugs into your smartphone’s headphone jack. It’s perfect for small businesses or individuals starting out. You can accept payments anywhere, anytime.

This reader works with both iOS and Android devices. Just download the Square app and you’re ready to go. It’s a simple and cost-effective way to begin accepting card payments. Plus, the setup is quick and hassle-free.

Affordable Hardware Options

For those needing more advanced tools, Square provides affordable hardware options. The Square Reader for contactless and chip costs just $49. It allows you to accept tap, dip, and swipe payments. This reader connects wirelessly to your device via Bluetooth.

Another option is the Square Stand for iPad. It costs $169 and turns your iPad into a complete point-of-sale system. The stand includes a built-in card reader and a dock for your iPad. It’s sleek, professional, and easy to set up.

Square Terminal is another affordable choice at $299. This all-in-one device accepts all payment types. It also prints receipts and runs the Square Point of Sale software. It’s portable and perfect for busy retail environments.

These affordable hardware options ensure that businesses of all sizes can use Square. Whether you’re a small shop or a growing business, Square has a solution for you.

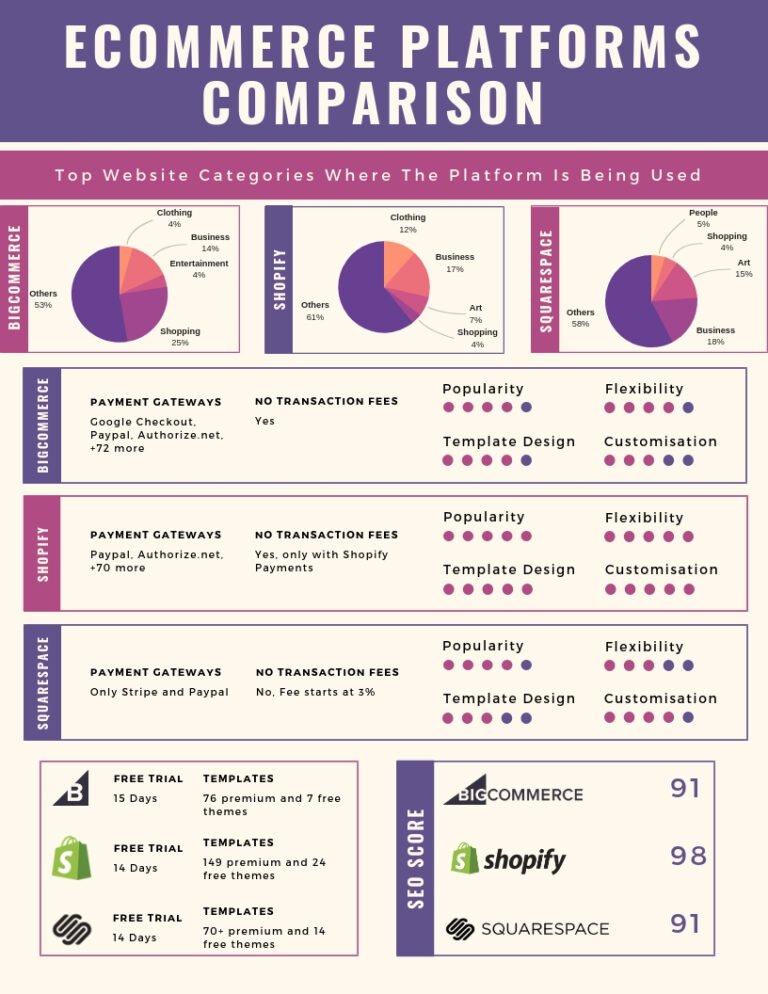

Payment Processing Fees

Understanding payment processing fees is crucial for businesses using Square. These fees can impact your overall costs. Knowing the details helps you manage your budget better.

Transaction Fees Breakdown

Square charges different fees based on the type of transaction. For in-person payments, Square typically charges 2.6% plus 10 cents per transaction. Online payments have a higher fee of 2.9% plus 30 cents per transaction. Manually entered card payments cost 3.5% plus 15 cents each.

These fees can add up quickly. It’s important to be aware of them. This helps in planning and pricing your products or services effectively.

Tips To Minimize Fees

Encourage customers to use in-person payments. These have the lowest fees. Avoid manually entering card details whenever possible. This helps to reduce higher fees.

Consider a flat-rate pricing plan if your transaction volume is high. It might save you money in the long run. Also, keep transactions as large as possible. This reduces the number of times fees are applied.

Review your payment processing regularly. Look for patterns and find ways to lower costs. Every little bit helps in saving money.

Managing Sales And Inventory

Managing sales and inventory is crucial for any business. Square provides affordable tools to help you stay on top of your sales and inventory management. This blog post will guide you through the cheapest ways to use Square for these tasks.

Using The Dashboard

The Square Dashboard is your command center. It’s where you can manage sales, track inventory, and generate reports. Here’s how to make the most of it:

- Sales Tracking: The dashboard lets you see all your sales in one place. You can filter by date, location, or employee.

- Real-Time Updates: Get real-time updates on your sales and inventory levels. This helps you make informed decisions quickly.

- Reports: Generate detailed sales reports. These reports help you understand your business performance.

Inventory Management Tools

Square offers several inventory management tools. These tools help you keep track of your stock and avoid overstocking or understocking. Here’s what you can use:

- Item Library: Create and manage a list of your items. Include details like price, description, and stock level.

- Stock Alerts: Set up alerts for low stock items. You’ll get a notification when it’s time to reorder.

- Inventory Reports: Generate inventory reports to see stock levels and movement. These reports help you identify best-selling items and slow movers.

Using Square’s dashboard and inventory management tools can save you time and money. You get a clear view of your sales and inventory without breaking the bank.

Integrating Square With Other Platforms

Integrating Square with other platforms can save time and reduce costs. This seamless integration allows businesses to manage multiple operations from one place. Let’s explore the best ways to integrate Square with e-commerce and accounting software.

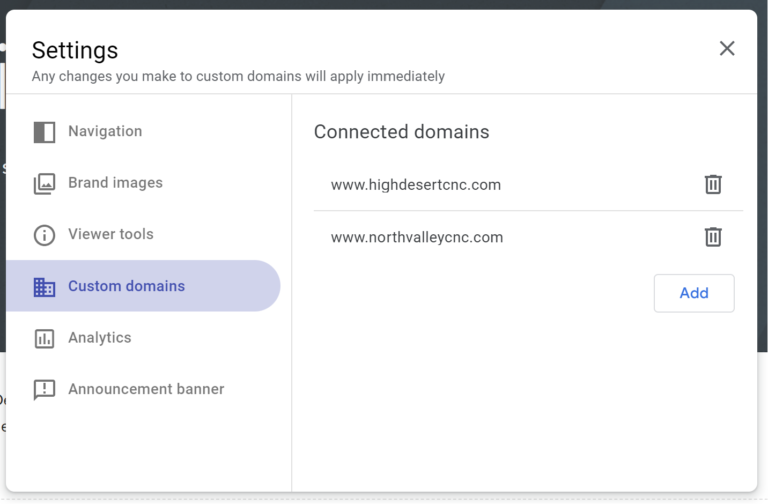

E-commerce Integrations

Square integrates well with many e-commerce platforms. This helps streamline online sales. Shopify, WooCommerce, and BigCommerce are popular options. These platforms sync with Square to manage inventory and process payments. The integration is simple and user-friendly. It ensures that your online store runs smoothly.

To set up, connect your Square account with the e-commerce platform. Follow the on-screen instructions. This process usually takes a few minutes. Once connected, you can start selling products online. Orders, payments, and inventory updates automatically sync between Square and your store. This reduces manual work and errors.

Accounting Software

Square also integrates with many accounting software. This helps manage finances with ease. QuickBooks, Xero, and Zoho Books are top choices. These tools sync with Square to track sales and expenses. They simplify bookkeeping tasks.

Connecting Square to your accounting software is easy. Sign in to your accounting software and find the Square integration option. Follow the steps to link your accounts. Once connected, your transactions automatically import into the accounting software. This saves time and ensures accurate financial records.

Credit: m.facebook.com

Maximizing Square’s Free Features

Maximizing Square’s free features can help you save money while growing your business. Square offers various tools at no cost. Use them to boost marketing, engage customers, and streamline operations. Focus on these free tools to make the most of your Square experience.

Marketing Tools

Square provides free marketing tools to help you reach more customers. Use Square’s email marketing to send updates and promotions. Customize your emails with templates. Track the performance of your campaigns in real-time.

Leverage Square’s social media integration. Connect your Square account with Facebook, Twitter, and Instagram. Post updates and special offers directly from your Square dashboard. This keeps your audience engaged without extra costs.

Create and offer digital gift cards. These are easy to set up and promote. Gift cards can attract new customers and increase revenue. Utilize Square’s free marketing tools to enhance your business visibility without spending extra.

Customer Engagement

Engage your customers using Square’s free features. Implement a simple loyalty program. Reward repeat customers with discounts or special offers. This encourages them to return and make more purchases.

Use Square’s customer directory. Store and manage customer information securely. Send personalized messages and offers based on their purchase history. This makes your customers feel valued and understood.

Collect customer feedback. Use Square’s feedback feature to get insights from your customers. This helps you improve your services and products. Engaging with customers builds trust and loyalty.

Maximize Square’s free features to improve customer engagement and satisfaction.

Tips For Small Businesses

Using Square can be cost-effective for small businesses. By following some smart strategies, you can minimize costs and maximize efficiency. Here are some helpful tips to get the most out of Square without breaking the bank.

Cost-saving Strategies

Small businesses can save money by using Square’s free tools. The free point-of-sale app is a great starting point. It offers essential features without any monthly fees.

- Avoid unnecessary add-ons: Only pay for features you need.

- Use Square’s free online store: Create a simple, no-cost online presence.

- Leverage Square’s free marketing tools: Send email campaigns at no additional cost.

- Take advantage of Square’s free invoicing: Issue invoices without extra charges.

When accepting payments, use Square Reader for magstripe, which is free. For chip cards and contactless payments, choose the low-cost Square Reader for contactless and chip. These devices keep hardware expenses minimal.

Optimizing Operations

Streamline your operations with Square’s inventory management features. Track stock levels in real-time without additional software costs. This helps avoid overstocking or running out of items.

Integrate Square with accounting software like QuickBooks. This reduces time spent on manual bookkeeping. Automate tasks like sales tracking and expense management to save time and money.

Utilize employee management tools within Square. Track hours, manage shifts, and calculate payroll with ease. These tools help keep labor costs in check while ensuring accurate payments.

Offer loyalty programs to encourage repeat business. Square’s loyalty features are easy to set up and use. Reward customers for their purchases without spending extra on third-party services.

Monitor sales data through Square’s reporting tools. Analyze performance, identify trends, and make informed decisions. This helps optimize business operations and increase profitability.

| Strategy | Benefit |

|---|---|

| Avoid unnecessary add-ons | Lower monthly costs |

| Use free online store | No web hosting fees |

| Leverage free marketing tools | Cost-effective promotions |

| Track inventory in real-time | Better stock management |

| Integrate with accounting software | Reduce manual bookkeeping |

Credit: www.tiktok.com

Frequently Asked Questions

What Is The Cheapest Way To Use Square?

The cheapest way to use Square is to choose their free plan. With this, you only pay transaction fees. No monthly fees.

Does Square Offer Any Free Features?

Yes, Square offers free features like a point-of-sale app and online store. These help you save costs.

How Can I Reduce Square Transaction Fees?

You can reduce Square transaction fees by negotiating volume discounts. Higher transaction volumes often qualify for lower fees.

Are There Any Hidden Costs With Square?

No, Square is transparent with its pricing. There are no hidden costs. You only pay for transactions.

Conclusion

Saving money while using Square is easier than you think. Focus on free features and basic plans. Avoid unnecessary add-ons. Use Square’s free processing options and save on fees. Try different strategies to find what works best. Always keep an eye on your expenses.

Making small changes can lead to big savings. Start saving today and make the most of Square.